Update 002.png, 003.png, 001.png, Offshift Ecosystem Whitepaper.md, Offshift...

Update 002.png, 003.png, 001.png, Offshift Ecosystem Whitepaper.md, Offshift anon Litepaper.md files

parents

Showing

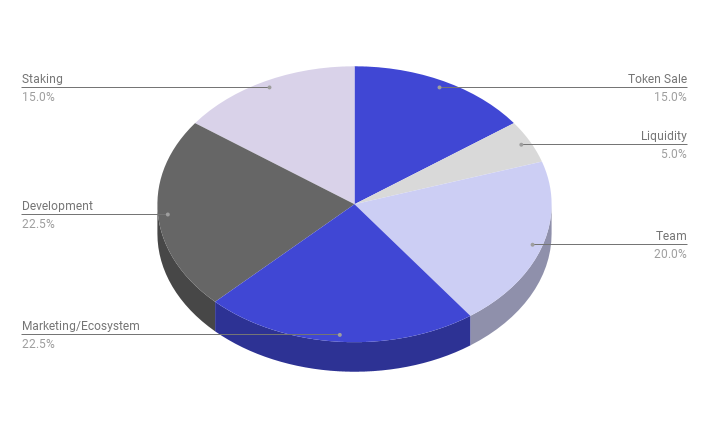

001.png

0 → 100644

144 KB

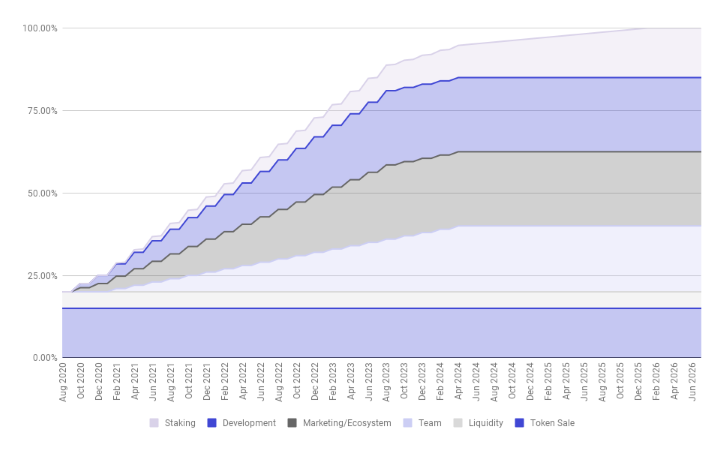

002.png

0 → 100644

22 KB

003.png

0 → 100644

42.2 KB

Offshift anon Litepaper.md

0 → 100644